How much can you normally borrow for a mortgage

Ad More Veterans Than Ever are Buying with 0 Down. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and.

Is It Time To Withdraw Money Or Borrow From Your 401 K Piggy Bank Cnn Underscored Investing For Retirement Payroll Taxes Retirement

Get Started Now With Rocket Mortgage.

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

. Theyll also look at your assets and debts your credit score and your employment. As a rule of thumb lenders will let you borrow roughly 45 x your yearly income for a mortgage before tax. Find out how much you can borrow using our mortgage borrowing calculator simply by answering a few questions.

Ad Looking For A Mortgage. Check Eligibility for No Down Payment. Your salary will have a big impact on the amount you can borrow for a.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. As a rule of thumb lenders will let you borrow roughly 45 x your yearly income for a mortgage before tax. Fill in the entry fields and click on the View Report button to see a.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. The first step in buying a house is determining your budget. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today.

Compare Mortgage Options Get Quotes. Check Eligibility for No Down Payment. BTL mortgages are considered a little riskier for lenders which means youll usually need at least a 25 deposit if not more.

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. Enter your salary below combined salaries for a joint application to see how much you could potentially borrow.

If you have a healthy and steady cash flow you can expect the amount to be twice as much as your income. If you are nervous or confident about your ability to afford a. Compare - Apply Get Cheap Rates.

But ultimately its down to the individual lender to decide. You may qualify for a loan amount of 252720 and your total monthly mortgage. You can usually borrow 50 to 60 of the combined costs of the land and construction however these mortgages are complex and specialist advice from a mortgage.

The Search For The Best Mortgage Lender Ends Today. Ad Compare the Best Mortgage Lenders Picked By Our Experts Get a Great Offer Apply Easily. You should expect to borrow 60-75 of the value of the property.

You need to make 166514 a year to afford a 450k mortgage. Offers Backed By Top Mortgage Lenders Save. As part of an.

Find A Lender That Offers Great Service. BTL mortgages are considered a little riskier for lenders which means. The cap is usually between 80-85 with most.

How much you can borrow for a. Trusted VA Home Loan Lender of 200000 Military Homebuyers. But this will vary depending on the lender and the type of mortgage.

Usually banks and building societies will offer up to four-and-a-half times the annual income of you and anyone you are buying with. Ad More Veterans Than Ever are Buying with 0 Down. Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements.

You could get an agreement in principle. Trusted VA Home Loan Lender of 200000 Military. The maximum amount you can borrow with an FHA-insured.

Discount points are paid upfront when you close on your loan. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Trusted VA Home Loan Lender of 200000 Military Homebuyers.

Check Eligibility for No Down Payment. For example if your income is 300000 all reputable mortgage. This would usually be based on 4-45 times your annual.

Typically you can borrow up to 45 times your income for a mortgage. Ad Work with One of Our Specialists to Save You More Money Today. Get Your Best Interest Rate for Your Mortgage Loan.

This mortgage calculator will show how much you can afford. Were Americas 1 Online Lender. Ad Find How Much Mortgage Can You Qualify For.

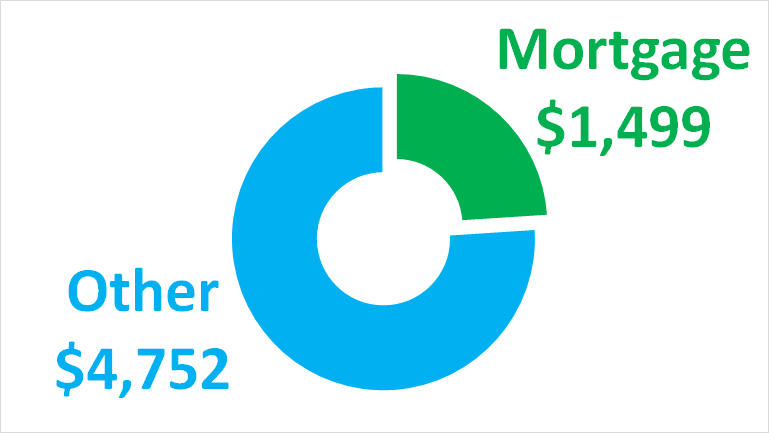

Your salary will have a big impact on the amount you can borrow for a mortgage. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. As a general rule lenders want your mortgage payment to be less than 28 of your current gross income.

Its A Match Made In Heaven. For instance some deals offer 55. As a rule of thumb lenders will let you borrow roughly 45 x your yearly income for a mortgage before tax.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Compare Mortgage Options Get Quotes. You should expect to borrow 60-75 of the value of the property.

Ad Compare More Than Just Rates.

I Make 75 000 A Year How Much House Can I Afford Bundle

How Can Get Poor Credit Financial Loans Refinance Loans Home Loans Mortgage Companies

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Agbo5fvxuoyi1m

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Pin By Anseth Richards On Farm Loans Farm Loan The Borrowers Borrow Money

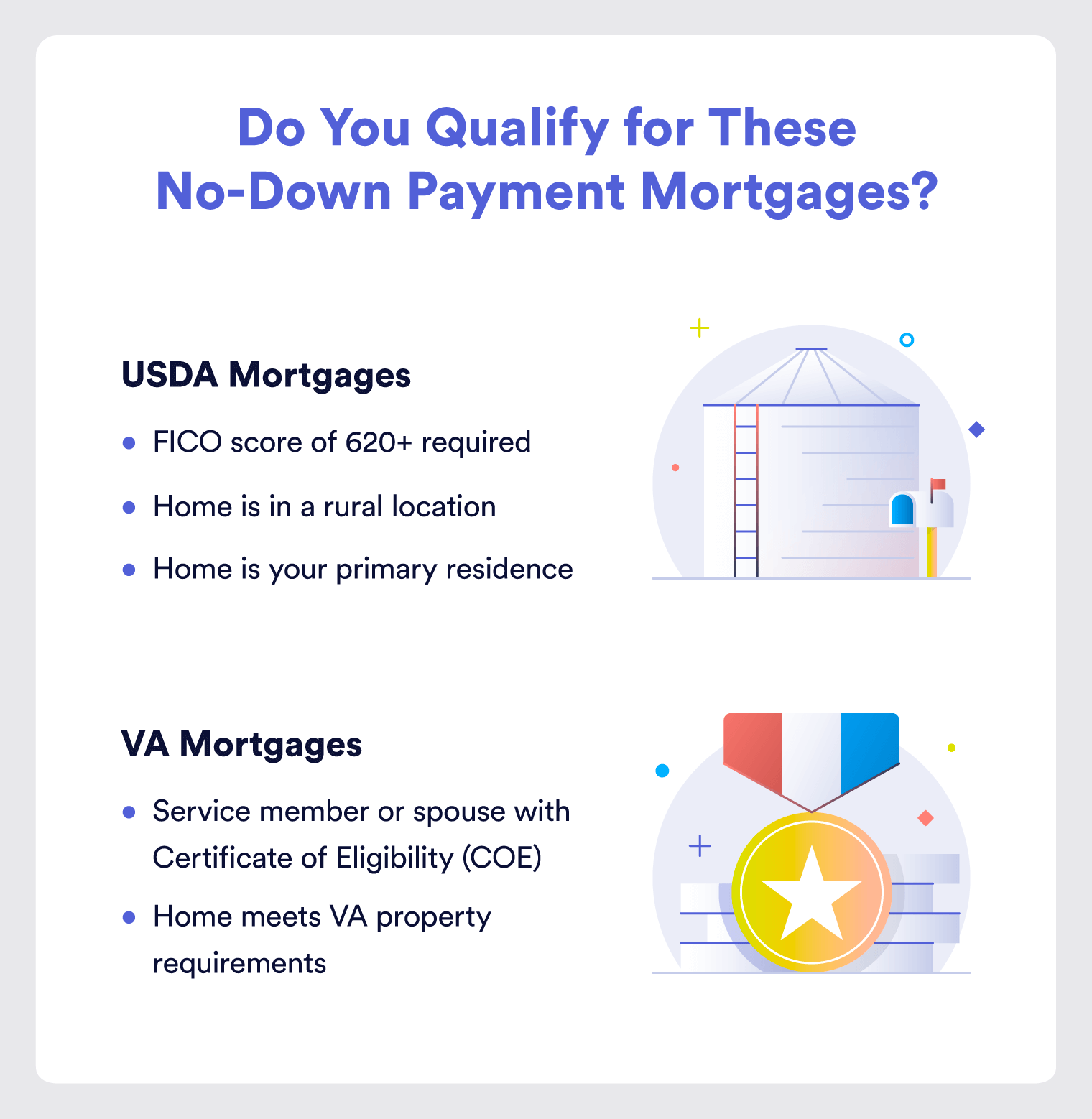

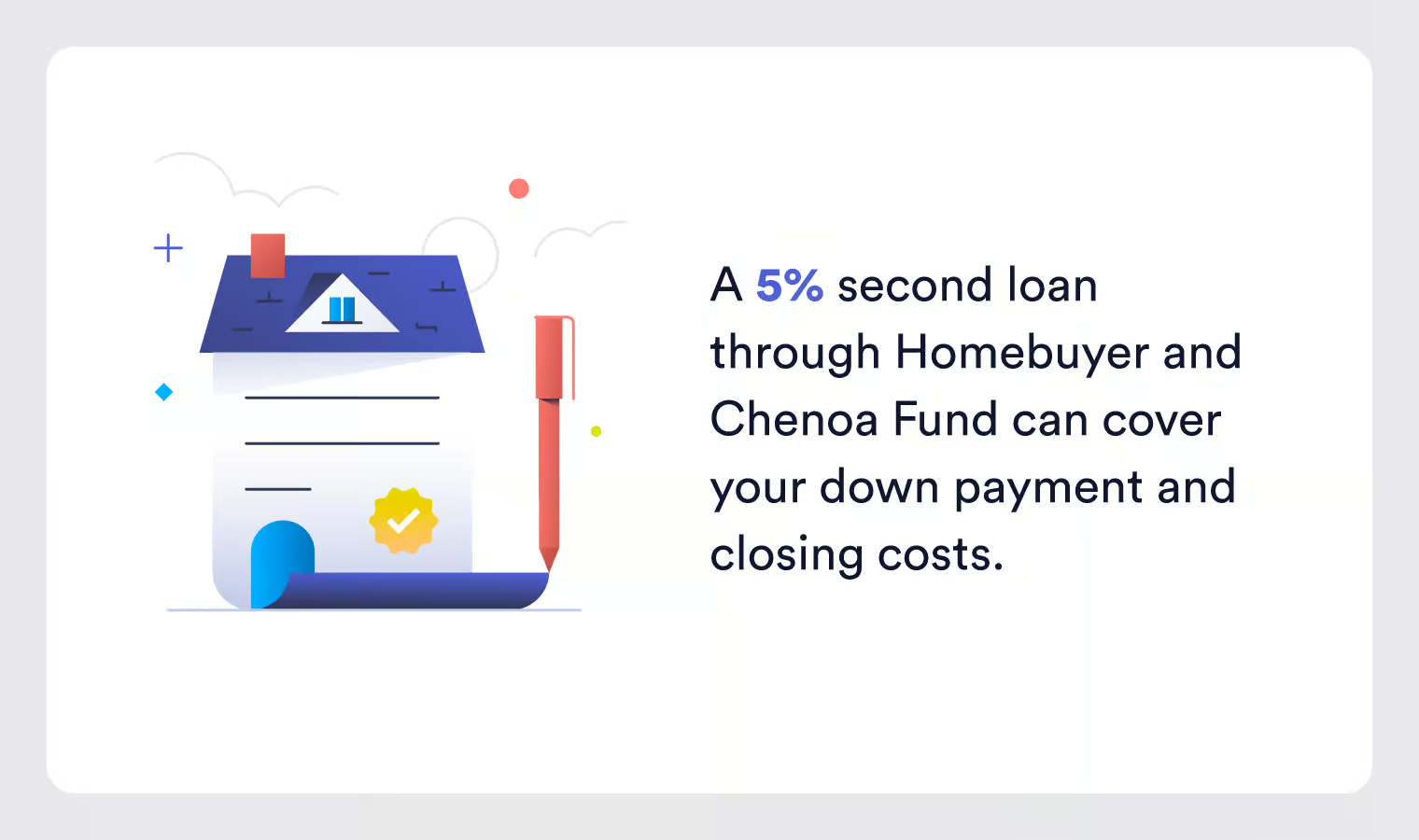

What Is 100 Mortgage Financing And How To Get It

What Is 100 Mortgage Financing And How To Get It

What Is A Mortgage

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Mortgage Points A Complete Guide Rocket Mortgage

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

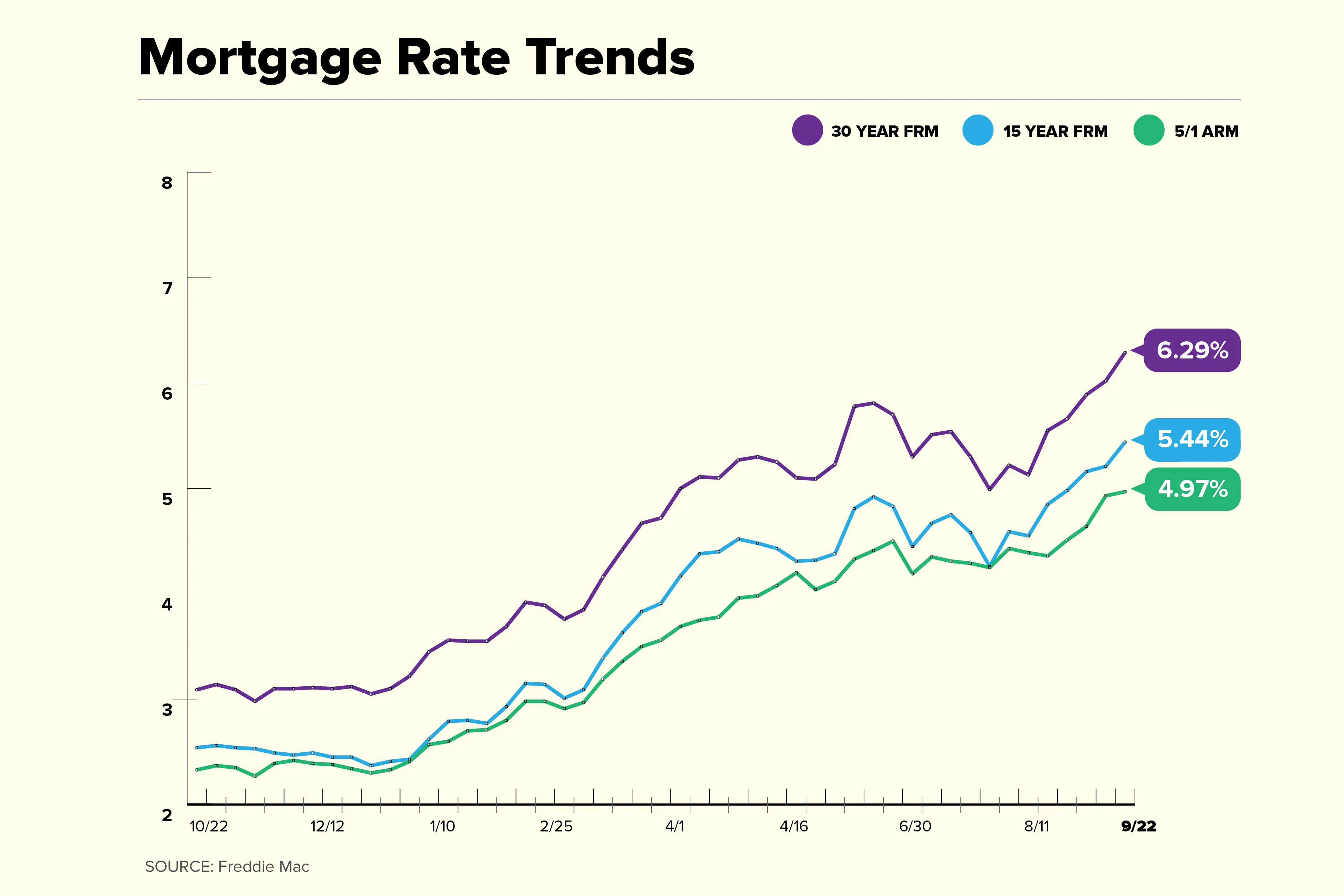

Current Mortgage Interest Rates September 2022

250k Mortgage Mortgage On 250k Bundle

How Much A 450 000 Mortgage Will Cost You Credible

Money Tribune Income Tax Deduction For Home Loan Under Section 24 80c And 80ee Buying A Home Is A Costing Affair For Any Investing Income Tax Tax Deductions

Q A All You Need To Know About Instalment Loans Loans For Bad Credit Apply For A Loan Loan Lenders